When a fundamentally strong stock suddenly drops more than 7% in a single trading session, it naturally raises eyebrows. That’s exactly what happened with Kaynes Technology India Limited, as Kaynes Tech’s Share price declined sharply following a major corporate announcement.

For retail investors, such movements often trigger emotional reactions — fear, panic selling, or opportunistic buying. But seasoned market participants understand that sharp price corrections often carry deeper context. The real question is not whether the stock fell. The real question is why it fell — and whether the drop reflects deteriorating fundamentals or temporary market sentiment.

In this detailed analysis, we examine Kaynes Tech’s Share performance, the announcement that triggered the decline, the company’s financial profile, sector dynamics, risks, and whether this pullback presents a strategic entry point.

Understanding Kaynes Technology: The Business Behind the Stock

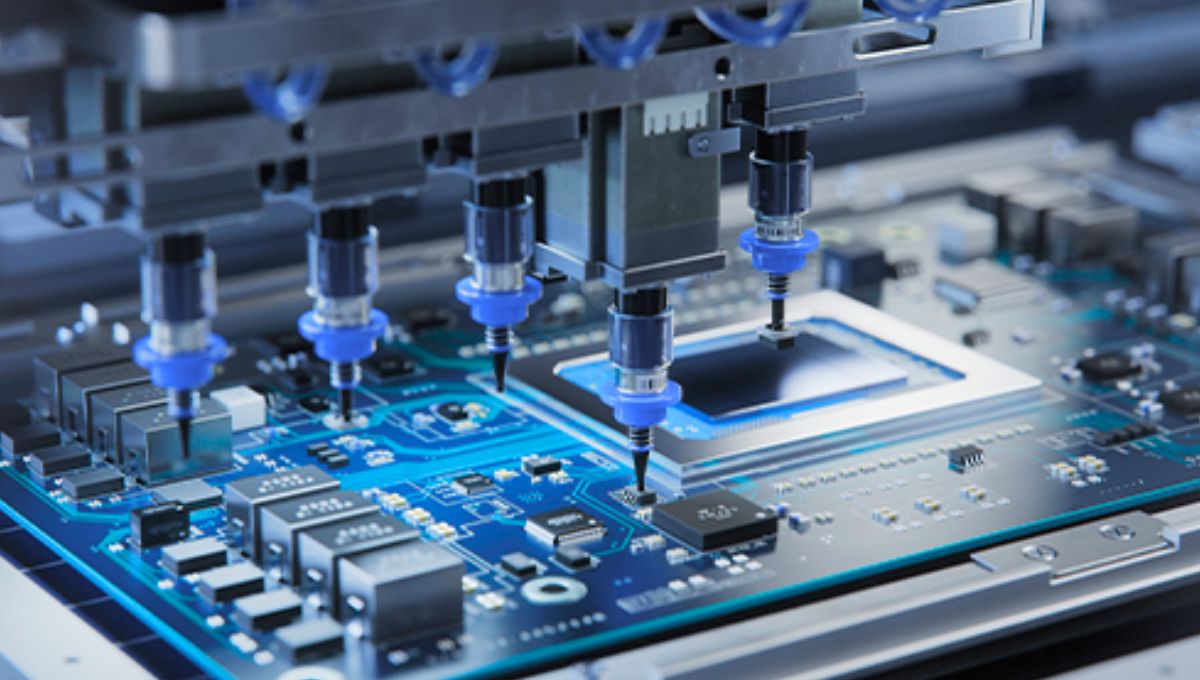

Kaynes Technology India Limited is one of India’s leading electronics manufacturing services (EMS) companies. The firm operates across high-growth segments such as:

- Industrial electronics

- Automotive electronics

- Aerospace and defense

- IoT solutions

- Railways and smart infrastructure

Unlike many EMS players that operate on thin margins, Kaynes has positioned itself as a value-added manufacturer, focusing on design-led manufacturing rather than pure assembly.

This differentiation has historically supported stronger margins and better revenue visibility compared to commoditized EMS competitors.

What Triggered the 7% Fall in Kaynes Tech’s Share?

The recent decline in Kaynes Tech’s Share price followed a corporate announcement that the market interpreted as potentially dilutive or margin-impacting.

While the specifics of such announcements often vary — whether it involves fundraising, capacity expansion, order restructuring, or management commentary — what matters is how investors interpret future cash flows.

A 7% correction in a single session typically signals one of the following:

- Concerns over earnings dilution

- Lower-than-expected revenue guidance

- Margin compression fears

- Increased capital expenditure

- Promoter stake movement

However, a sharp correction does not automatically indicate a structural problem. Often, it reflects short-term uncertainty.

Market Psychology: Why Sharp Reactions Happen?

In today’s markets, speed often overrides analysis. Algorithmic trading, retail panic, and momentum-based strategies amplify volatility.

When an announcement introduces uncertainty, even if long-term neutral or positive, short-term traders may exit quickly. This creates:

- Sudden liquidity pressure

- Stop-loss triggers

- Technical breakdown signals

- Cascading sell orders

In many cases, the price decline overshoots the fundamental impact.

Key Specs and Performance Metrics

To evaluate whether the drop in Kaynes Tech’s Share price is justified, we must examine the numbers.

Business Specifications (Operational Overview)

- Industry: Electronics Manufacturing Services (EMS)

- Core Segments: Automotive, Aerospace, Industrial IoT, Railways

- Manufacturing Units: Multiple facilities across India

- Business Model: Design-led integrated manufacturing

Financial Metrics (Recent Snapshot)

While exact figures fluctuate by quarter, the company has historically demonstrated:

- Strong year-on-year revenue growth

- Healthy EBITDA margins compared to peers

- Expanding order book visibility

- Increasing domestic and export footprint

Key performance indicators investors monitor include:

- Revenue growth rate

- EBITDA margin stability

- Order book size

- Debt-to-equity ratio

- Return on capital employed (ROCE)

If these remain intact post-announcement, the price correction may be sentiment-driven rather than structurally justified.

Was Kaynes Tech’s Share Overheated?

One important factor often ignored during panic reactions is prior valuation.

Kaynes Technology has been a high-growth story, and growth stocks often trade at premium multiples. If a stock trades at elevated price-to-earnings (P/E) or price-to-sales ratios, even minor negative surprises can trigger sharper corrections.

Premium valuations create:

- High expectations

- Low tolerance for execution misses

- Volatility around news events

Therefore, the 7% fall might reflect a resetting of valuation expectations rather than fundamental weakness.

Sector Dynamics: EMS Industry in India

The broader electronics manufacturing ecosystem in India is undergoing structural transformation due to:

- Production Linked Incentive (PLI) schemes

- China-plus-one manufacturing strategy

- Rising domestic demand for electronics

- Defense and aerospace indigenization

Companies like Kaynes Technology benefit from these macro tailwinds.

However, the sector also faces challenges:

- Component supply chain volatility

- Margin pressure due to competition

- Working capital intensity

- Global demand fluctuations

Understanding this broader context is essential before reacting to short-term price movements.

Risk Assessment: What Could Justify Investor Concern?

While long-term growth prospects appear intact, investors should objectively consider risk factors.

1. Capital-Intensive Expansion

If the recent announcement involved large capital expenditure plans, short-term cash flow pressure could emerge.

2. Equity Dilution Risk

If fundraising through equity was announced, existing shareholders may face dilution, impacting per-share earnings.

3. Margin Compression

Rising raw material costs or competitive pricing could compress margins.

4. Order Book Concentration

High reliance on a few large clients could increase revenue concentration risk.

Risk assessment is not pessimism. It is disciplined investing.

Technical Perspective: What Charts Suggest?

From a technical standpoint, a 7% drop often breaks short-term support levels.

Investors watch:

- 50-day moving average

- 200-day moving average

- Volume spikes

- Relative Strength Index (RSI)

If the decline occurs with unusually high trading volume, it may signal institutional repositioning rather than retail panic.

However, if the price stabilizes quickly, it could indicate absorption by long-term investors.

Long-Term Investment Thesis: Intact or Weakening?

The key question remains: Has the core growth story changed?

For Kaynes Tech’s Share to remain attractive long-term, the following must hold true:

- Strong order inflows

- Consistent margin profile

- Controlled debt levels

- Sustainable revenue growth

If these pillars remain stable, a 7% correction may be viewed as volatility rather than deterioration.

Strategic Opportunity or Caution Signal?

There are two rational interpretations.

Viewpoint 1: Panic Reaction

If fundamentals remain unchanged, this drop could represent:

- Temporary sentiment shock

- Valuation reset

- Entry opportunity for long-term investors

Historically, quality mid-cap growth stocks often correct sharply before resuming upward momentum.

Viewpoint 2: Early Warning Sign

If the announcement impacts earnings visibility or capital structure materially, the correction may reflect:

- Forward-looking market pricing

- Reduced growth expectations

- Re-rating of valuation multiple

Investors must analyze earnings commentary carefully.

Expert Take: How Should Investors Respond?

Rather than reacting emotionally, investors should:

- Review official company communication in detail

- Compare pre- and post-announcement earnings projections

- Evaluate debt and cash flow impact

- Monitor institutional holding trends

- Avoid leverage-based decisions

A disciplined approach separates informed investors from speculative traders.

Comparing Kaynes Tech With Peers

Within the Indian EMS ecosystem, competition is intensifying. Companies are racing to expand capacity and secure long-term contracts.

Kaynes differentiates itself through:

- Integrated design capabilities

- Multi-sector diversification

- Higher margin positioning

If these advantages remain intact, temporary stock volatility may not undermine long-term prospects.

Broader Market Conditions Matter

Sometimes stock-specific announcements coincide with broader market weakness.

Mid-cap and small-cap stocks often experience sharper swings during:

- Rising interest rate cycles

- Global risk-off sentiment

- FIIs reducing exposure

- Sector rotation

Therefore, Kaynes Tech’s Share movement must be viewed in broader market context.

Panic or Opportunity?

A 7% drop is significant but not catastrophic in high-growth mid-cap stocks.

The key lies in distinguishing:

- Structural change

- Tactical volatility

If the business fundamentals remain strong and growth visibility remains intact, this correction may offer long-term investors a more reasonable entry valuation.

However, if earnings projections weaken materially, caution is warranted.

In markets, price moves fast. Fundamentals move slowly. The investor’s job is to identify which one is driving the narrative.

Kaynes Tech’s Share price decline reflects the complex interaction between corporate announcements, valuation expectations, and market psychology.

Whether this is a panic reaction or a strategic opportunity depends on one critical factor: the durability of the company’s earnings growth trajectory.

For informed investors, volatility is not the enemy. Lack of clarity is.

FAQs

Why did Kaynes Tech’s Share price fall 7%?

The drop followed a corporate announcement that introduced uncertainty regarding future financial performance. Markets often react sharply to unexpected updates.

Is Kaynes Technology fundamentally strong?

Historically, the company has shown strong revenue growth and healthy margins within the EMS sector. Investors should review the latest financial statements to assess current strength.

Should I buy Kaynes Tech’s Share after the dip?

That depends on your investment horizon, risk appetite, and evaluation of the company’s revised outlook. Long-term investors may see value if fundamentals remain intact.

Does a 7% drop indicate serious trouble?

Not necessarily. Growth stocks often experience volatility. The significance depends on whether the announcement affects long-term earnings power.